Auto Loan Refinance

Refinance your car and start saving today

Lower car payments are just a few clicks away!

Average payment savings

$116.71/month*

Car loans refinanced

700,000+

Your kind of loan

We’ve streamlined the auto lending process from start to finish. The simplicity of our online application process combined with our diverse network of lenders makes it easy for us to find the most competitive rates and deliver the offer that works best for you.

Utilize our easy online process

1. Apply in minutes

Ready to save on your car payments? Fill out your application online or over the phone, just enter a few easy details about you and your vehicle and we’ll have you on your way.

2. Confirm your details

We’ll let the numbers speak for themselves. Our network of trusted lending partners compete to deliver you the lowest interest rates available**.

3. Sign & finalize online

Sign your documents with just a few taps from your own mobile device, and you are ready to go. Interest accrues from the date of the new finance contract.

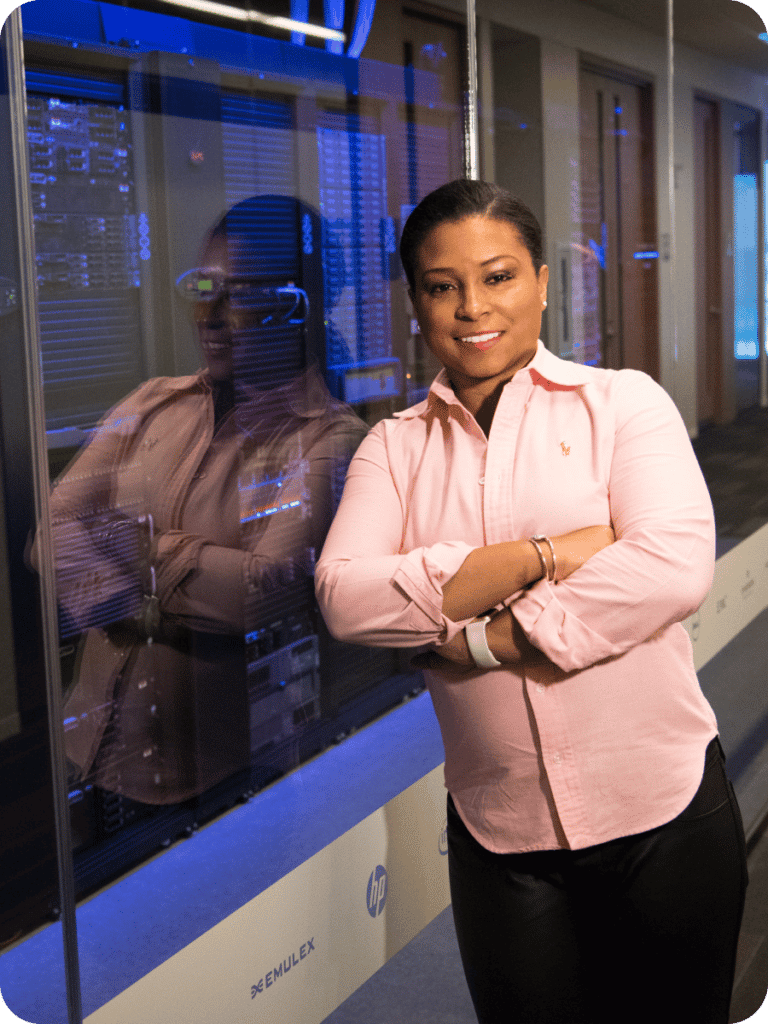

Shop with confidence

With our network of lenders, we have solutions for all credit profiles. Knowing how important an auto loan can be for financial freedom (and mobility), we work with customers across the credit spectrum to find fair rates.

Types of refinancing

Traditional

- Reduce your monthly payments or interest

- Shorten the length of your loan

- You can add or subtract additional persons from your loan

Cash back

- Receive as much as $12,000 cash back

- Use funds to pay high interest obligations

- Consolidate debt, or use the payout towards personal costs

Lease buyout

- Pay off your lease early

- Avoid paying high mileage and other fees

- Keep your car at the end of your base term, is that simple

Your security is our first priority

We use 128-bit encryption, the same security major banks use, and would NEVER sell your personal information to third parties. No need to visit banks or talk to multiple parties. We handle the whole refinance transaction.

Refinance your auto loan and save.

You can apply in minutes.