Quick Answer:

Most people assume there is a restriction on the number of times you can refinance a car, but there is no legal limit. You can refinance your vehicle as many times as you want. However, that doesn't mean that you should refinance your car every chance you get. There are other factors to consider, such as the impact on your credit score and the amount of money you'll save.

Refinancing a car means taking out a new loan to pay off the balance of your existing loan. This can be done for various reasons, such as getting a lower interest rate or extending the loan term. While there are some advantages to refinancing, there are still some risks. For example, if you extend the duration of your loan, you pay more interest in the long run. And if you refinance multiple times, you could end up with a negative equity in your car (meaning you owe more than the car is worth).

Let’s explore why refinancing a car might be a good idea and some of the top questions people have about refinancing multiple times.

Table of Contents:

- Why Would You Refinance a Car?

- Why Refinance a Car Again?

- Top Questions About Refinancing a Car Multiple Times

- The Bottom Line on Refinancing More Than Once

Why Would You Refinance a Car?

Most people refinance their car when they can no longer afford their monthly payments or want to lower their interest rate. When you refinance your car, you take out a new loan with new terms to replace your old loan. Remember that refinancing does not eliminate your debt. Still, it may help you lower your monthly payments or save on interest. And with auto debt continuing to rise, according to the Federal Reserve Bank of New York, it’s no wonder folks are trying to find ways to lower their payments.

Let’s take a closer look at these three reasons to refinance a car.

1. You can no longer afford your monthly payments. If you struggle to make your monthly car payments, refinancing may be a good option. By refinancing your car, you may be able to lower your monthly payments and free up some extra cash each month.

2. You want to lower your interest rate. If you qualify for a lower interest rate, refinancing may help you save money on interest over the life of your loan. A lower interest rate could also help you pay off your debt sooner.

3. You want to change the terms of your loan. If you originally agreed to a 60-month loan but now want to pay off your debt sooner, refinancing for a 48-month or 36-month loan could be a good option. Or, if you originally agreed to a 36-month loan but now want to lower your monthly payments, refinancing for a 60-month loan could be a good option for you.

Why Refinance a Car Again?

If you’ve already refinanced your car once, you may wonder if it’s worth refinancing again. The answer to this question depends on a few factors, such as your current interest rate, the terms of your new loan, and your financial goals.

- High-Interest Rates – If you’re currently paying a high-interest rate, refinancing may help you save money on interest over the life of your loan. For example, let’s say you have a $20,000 loan with an interest rate of 15 percent. Over 60 months, you would end up paying $6,000 in interest. However, if you could refinance for a lower interest rate of 10 percent, you would only end up paying $4,000 in interest, a savings of $2,000.

- Change of Loan Terms – This is no different than the first time you refinanced. If you want to change the terms of your loan, such as the length of the loan or the monthly payments, refinancing may be a good option for you.

- Financial Goals – If you have other financial goals, such as saving for a down payment on a house or taking a much-needed vacation, refinancing may help you free up some extra cash each month. For example, let’s say you have a $15,000 loan with an interest rate of 10 percent and monthly payments of $350. If you refinanced for a 60-month loan with an interest rate of 15 percent, your monthly payments would decrease to $308. However, you would end up paying $3,000 more in interest over the life of the loan, but the trade-off could be worth it if you need the extra cash each month to reach your financial goals.

Top Questions About Refinancing Multiple Times

If you’re considering refinancing your car for a second time — or third, or fourth, or… — you probably have questions about the process. Here are some of the top questions people have about refinancing multiple times.

How soon can you refinance a car?

There is no legal time limit on how soon you can refinance a car after purchase or a previous refinance. Still, some technical and administrative considerations might make it more challenging to do so.

- Lenders’ Policies – The first consideration is the policy of the lender you used to finance your car. Some lenders have strict policies about refinancing and may not allow it within the first year or two of the original loan. In addition, if you try to refinance with the same lender, they may require you to pay a penalty before approving the new loan. This might make it more complicated and expensive to refinance soon after getting a car loan. Having said that, if you’re in a period where lenders are worried about auto loan default rates (like during an economic recession), they may be more willing to work with you on refinancing.

- Vehicle Title Transfer – Another consideration is the transfer of the vehicle title. In most states, the title must be transferred from the old lender to the new one. This process can take two to three months, so it may not be possible even if you want to refinance quickly.

- Refinancing and Your Credit Score – Finally, keep in mind that refinancing can temporarily ding your credit score. So if you’ve recently refinanced, you may not have the best credit and not qualify for great loan options again. That said, if you’ve been making your payments on time and have improved your credit since refinancing, you may get a better loan this time.

Does refinancing a car mean starting over?

Rather than considering it as starting over, it’s more helpful to consider it a fresh start. When you refinance, you’re taking out a new loan and using the same car as collateral. The new loan may have different terms from the original loan, such as a lower interest rate, different monthly payments, or a different loan length.

Can I refinance if I have a low credit score?

While it’s possible to refinance with a low credit, it may be challenging to get approved for a new loan. This is because lenders will consider your credit score and history when deciding whether or not to approve your loan. In addition, if your credit is low, you may not qualify for the best loan terms, such as a low-interest rate.

One way to deal with refinancing with low credit is to get a cosigner for your loan. This is someone who agrees to sign the loan with you and is responsible for the payments if you can’t make them. Having a cosigner will help you get approved for a loan and may even help you qualify for better terms. However, be sure that this is someone who understands that they’re taking on a big responsibility and is willing and able to make the payments if you can’t.

Is it wise to refinance multiple times?

If refinancing means saving money or making your financial situation more comfortable, then it is smart to do it multiple times. However, if refinancing will only extend the life of your loan without providing any real benefit, you may want to avoid it. Also, consider the refinancing costs, such as application and title transfer fees, which can add up if you do it multiple times.

Does refinancing a car hurt your credit?

Refinancing your car will not permanently hurt your credit. Instead, it temporarily lowers your credit score because it triggers a hard inquiry on your credit report. However, your score will rebound after a few months if you make all your payments on time. For this reason, many people find that refinancing actually helps improve their credit score.

Does refinancing give you more money?

This depends on your refinancing terms, goals, and whether you’re searching for “more money” immediately, every month, or throughout your loan.

- More Money Monthly – Lowering your monthly payments increases your immediate disposable income. But while it may seem like you have more money, you’re likely extending the life of your loan and paying more interest in the long run. That means that overall, you come out with less money long-term.

- More Money Saved – If you’re looking to save money over the long haul, a more aggressive refinancing strategy with a shorter term and/or higher monthly payments may do it. For example, if you refinance from a 60-month loan to a 48-month loan, you may pay more each month which reduces your disposable income. However, you’ll save on interest and be debt-free sooner.

Can you refinance a car loan with the same bank?

Technically, this is possible. However, the same bank, credit union, or other lenders may not offer you the best terms. Therefore, comparing rates and terms from multiple lenders is always a good idea before deciding on a loan.

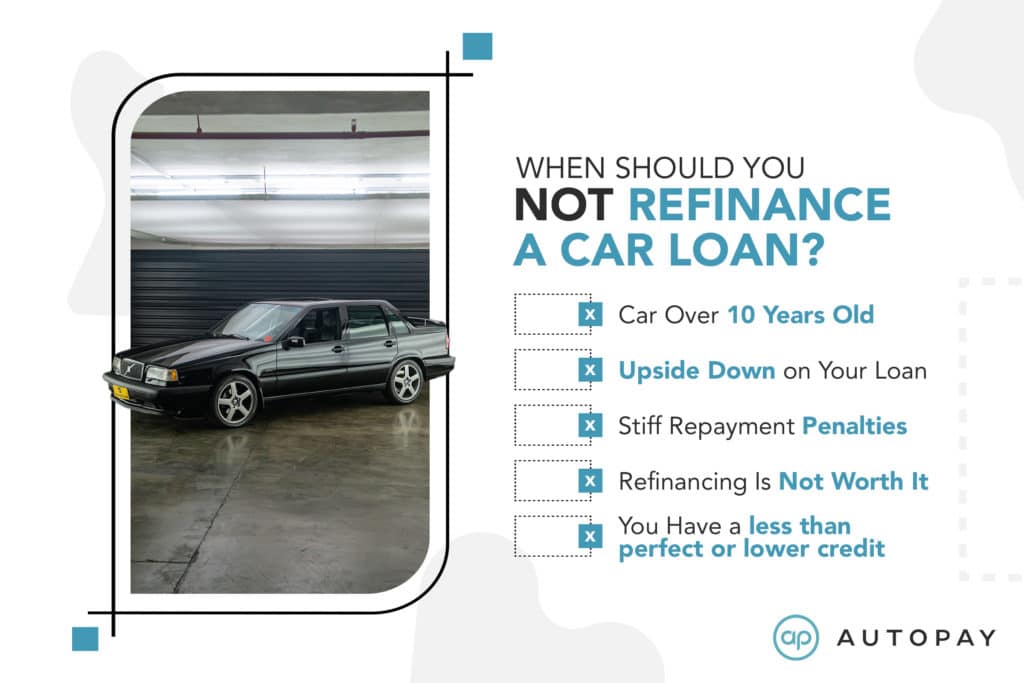

When should you not refinance a car loan?

While there are many advantages and incentives to refinancing a car loan, there are also some situations where it may not be the best idea or you simply can’t due to rules and regulations with lenders.

- Car Over 10 Years Old – Cars over 10 years old are generally refused by most lenders for refinancing. They typically only refinance loans for newer cars because they view them as having a greater resale value. As such, they see them as a less risky investment and are more likely to approve a loan for one of these cars. If your car is an older model, you might get approved for a refinance loan, but it will likely come with a higher interest rate. Alternatives to refinancing could entail taking out a personal loan or using the car as a trade-in when purchasing a new vehicle.

- You’re Upside Down on Your Loan – If you owe more on your car loan than your car is currently worth, you may have difficulty refinancing your loan. This is because lenders typically only refinance loans for borrowers with equity in their vehicle — meaning the car’s value is greater than the remaining balance on the loan. If you’re upside down on your loan, you may be able to roll the negative equity into a new loan, but this will likely extend the length of your loan and increase your monthly payments. It also puts you at risk of once again being upside down on your loan in the future.

- Your Loan Has Stiff Repayment Penalties – Before refinancing your car loan, check the terms of your current loan agreement. Some lenders charge penalties — known as prepayment penalties — for borrowers who pay off their loans early. These penalties can add substantial amounts to the cost of refinancing your loan, so it’s essential to be aware of them before making a decision.

- Refinancing Is Not Worth It – There are certain periods when it’s not financially advantageous to refinance your car loan. For example, if there are less than 12 months on your loan, refinancing costs may outweigh savings. Similarly, if interest rates have increased since you initially took out your loan, you may be unable to secure a lower rate. In these cases, it’s usually best to stick with your current loan.

- You Have a Low Credit Score – Borrowers with a lower credit score may have difficulty qualifying for auto refinancing. Lenders typically only approve borrowers with high or excellent credit for refinancing products. If you have a low credit score, you may still be able to get approved for a loan, but it will surely come with a higher interest rate. This often negates the savings from refinancing in the first place, so it’s usually not worth it.

How do I know if refinancing is right for me?

The best way to decide if refinancing is right for you is to compare the terms of your current loan with the terms of potential new loans. Look at things like the interest rate, monthly payments, and length of the loan. It might be worth refinancing if you can get a lower interest rate or better terms. Consider all the costs involved in getting a new loan, such as application and title transfer fees. You don’t want to pay more in the long run just because you refinanced. Using a refinance car loan calculator is an excellent place to start your research.

The Bottom Line on Refinancing More Than Once

If you’re considering refinancing your car, there’s no limit to how many times you can do it. However, keep in mind the lender’s policy on refinancing, the administrative process of title transfer, and the impact on your credit score. Refinancing can be a great way to save money on interest or change the terms of your loan, but make sure to consider all the factors before making a decision.